File with LARGEST For the Largest Refunds !

GET UP TO $9,500 ADVANCE

SAME DAY

NO CREDIT CHECK

Let's get you the Maximum!

Certified Tax Pro Max Services

We're your trusted Tax Pros, ensuring a accurate smooth and easy

process ensuring your'e Maximizing your Refund!

Are You Maximizing Tax Deductions?

Our mission is to provide exceptional tax services and financial guidance specifically tailored to our clients financial needs. We understand the unique challenges and responsibilities taxpayers face when it comes to managing their finances and tax.

Your Tax Pros Committed To Helping Our Clients Succeed

Running a business is challenging-managing taxes doesn't have to be.

Our business tax services are designed to help you stay compliant, minimize liability, and ensure accurate flings. Whether you're a sole proprietor or managing multiple streams of income, we tailor our approach to meet your unique needs. Certified Tax Pros Over 12 years of successfully helping thousands of clients in all 50 states.

A master in tax preparation and personalized services to individuals and businesses. She aim to simplify the process, empower our clients in making informed decisions and make a positive impact on our community.

Individual Tax Preparation Navigating personal taxes can be overwhelming, but we make it simple. Our experienced professionals will ensure your return is accurate and optimized to maximize your refund. We stay up-to-date with the latest tax laws to guarantee that you're taking advantage of every credit and deduction available.

Tax Solutions for Individuals and Businesses

We provide comprehensive tax services to optimize deductions, ensure compliance, and offer audit representation. Our expert advice covers income tax, credits, and retirement planning, tailored to each client's needs. Our goal is to minimize tax liabilities and maximize refunds.

Maximum Refunds

Individual Tax Preparation

Our tax professionals maximize returns by identifying eligible deductions and credits for each client. We ensure accuracy and compliance with current tax laws, providing personalized guidance to help clients retain more income and achieve their financial goals.

Audit Protection

We provide professional representation and support in the event of an IRS audit or inquiry. By having a dedicated team of professionals manage the audit on their behalf, our clients can minimize stress and potentially mitigate any adverse outcomes.

Cash Advance

We give clients early access to a portion of their anticipated tax refund, available from January 2nd to mid-February. With amounts up to $9,500, clients can access funds within 24-48 hours for immediate needs, providing a convenient way to bridge the gap until the full refund is received.

Business Tax

Services

Running a business is challenging-managing taxes doesn't have to be.

Our business tax services are designed to help you stay compliant, minimize liability, and ensure accurate flings. Whether you're a sole proprietor or managing multiple streams of income, we

tailor our approach to meet your unique needs.

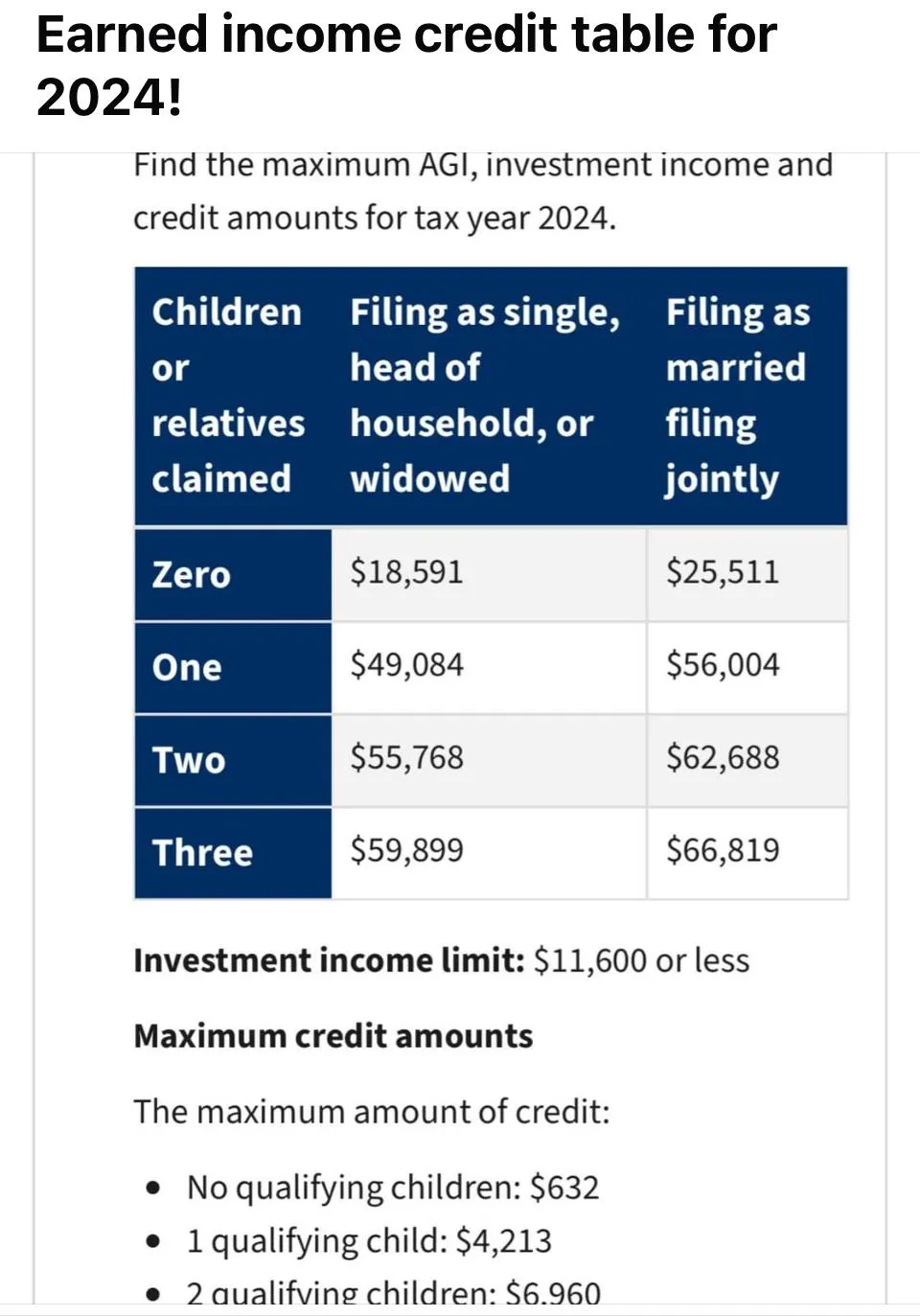

Stay ahead, Stay Informed: Tax Laws Made Easy!

Individual Tax Preparation Navigating personal taxes can be overwhelming, but we make it simple. Our experienced professionals will ensure your return is accurate and optimized to maximize your refund. We stay up-to-date with the latest tax laws to guarantee that you're taking advantage of every credit and deduction available. your trusted tax advisors, we aim to simplify the complex world of taxes for you. Staying informed about tax laws and regulations is essential for effective financial management. We offer valuable insights from the IRS to keep you updated and confident in navigating tax complexities. Discover our resources and expert guidance to make tax season a smooth and stress-free experience.

Taxpayers face issues from 2024 tax law changes and pandemic challenges. The IRS is updating info for 2022 returns and pending previous year returns.

FS-2024-03, Feb. 2024 — This fact sheet updates frequently asked questions about Form 1099-K. These updates contain substantial changes within each section.

FS-2024-04, Feb. 2024 — This Fact Sheet updates frequently asked questions for the Child Tax Credit.

FS-2024-03, Feb. 2024 — This fact sheet updates frequently asked questions about Form 1099-K. These updates contain substantial changes within each section.

Click below to access the IRS website for detailed information on tax-related topics, empowering you to make informed financial decisions and navigate the tax system with confidence.

Write a message

POPULAR FORMS

Form 1040- Individual Tax

Return

Form 4506-T- Request for Transcript of Tax Return

Form W-2- Employers engaged in a trade or business who pay

Form 9465- Installment Agreement Request

COMPANY

CUSTOMER CARE

FOLLOW US

LEGAL

Integrity

Honesty and transparency.

Innovation

Fresh, creative solutions.

Excellence

Top-notch services.

Copyright 2018 Certified Tax Pros. All Rights Reserved.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok